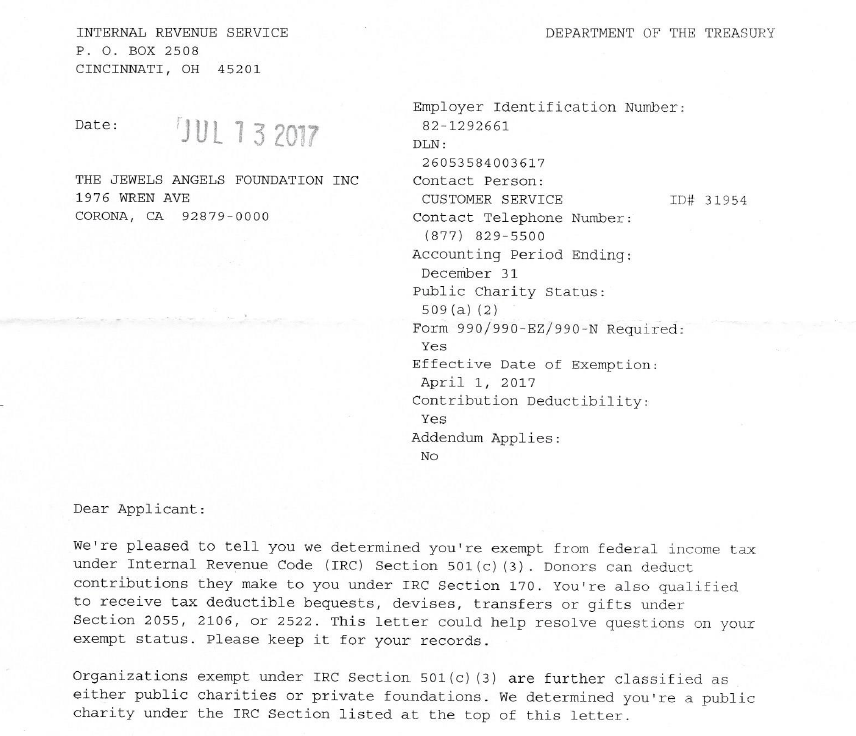

The Jewels’ Angels Foundation, Inc. is a non-profit 501(c)(3) organization. All donations to our organization are 100% tax deductible. We are registered in the following states:

California

Montana

Oregon

Our Guide Star Seal of Transparency link to our organization:

Per our Determination Letter from the Internal Revenue Service:

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual. In addition, it may not attempt to influence legislation as a substantial part of its activities, and it may not participate in any campaign activity for or against political candidates. Organizations described in section 501(c)(3) are commonly referred to as charitable organizations. Organizations described in section 501(c)(3), other than testing for public safety organizations, are eligible to receive tax-deductible contributions in accordance with Code section 170.

You must be logged in to post a comment.